Stories of Female Entrepreneurs Funded by PCR

Women are starting and growing businesses at an extraordinary pace — in food, childcare, creative services, real estate, tech, and beyond. But women founders still report lower approval rates and less favorable terms when approaching traditional lenders.

Women are starting and growing businesses at an extraordinary pace — in food, childcare, creative services, real estate, tech, and beyond. But women founders still report lower approval rates and less favorable terms when approaching traditional lenders.

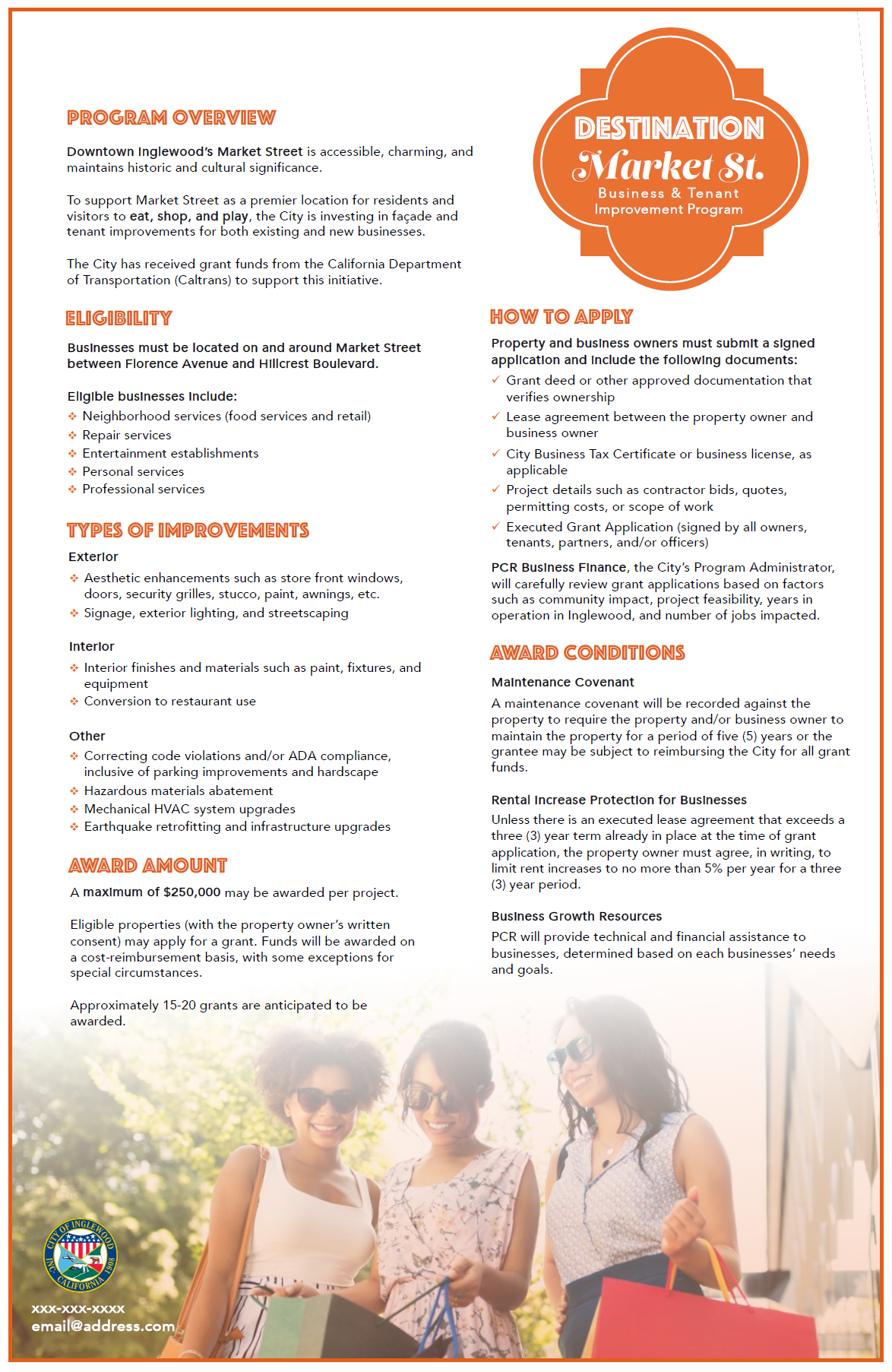

One example is Velvet Home Staging, a woman-owned business in San Leandro specializing in preparing residential spaces for sale. By accessing PCR lending, Velvet Home Staging was able to invest in inventory and scale its service capacity. This type of investment matters because it allows women entrepreneurs to step into higher-value contracts and control their own growth timeline.

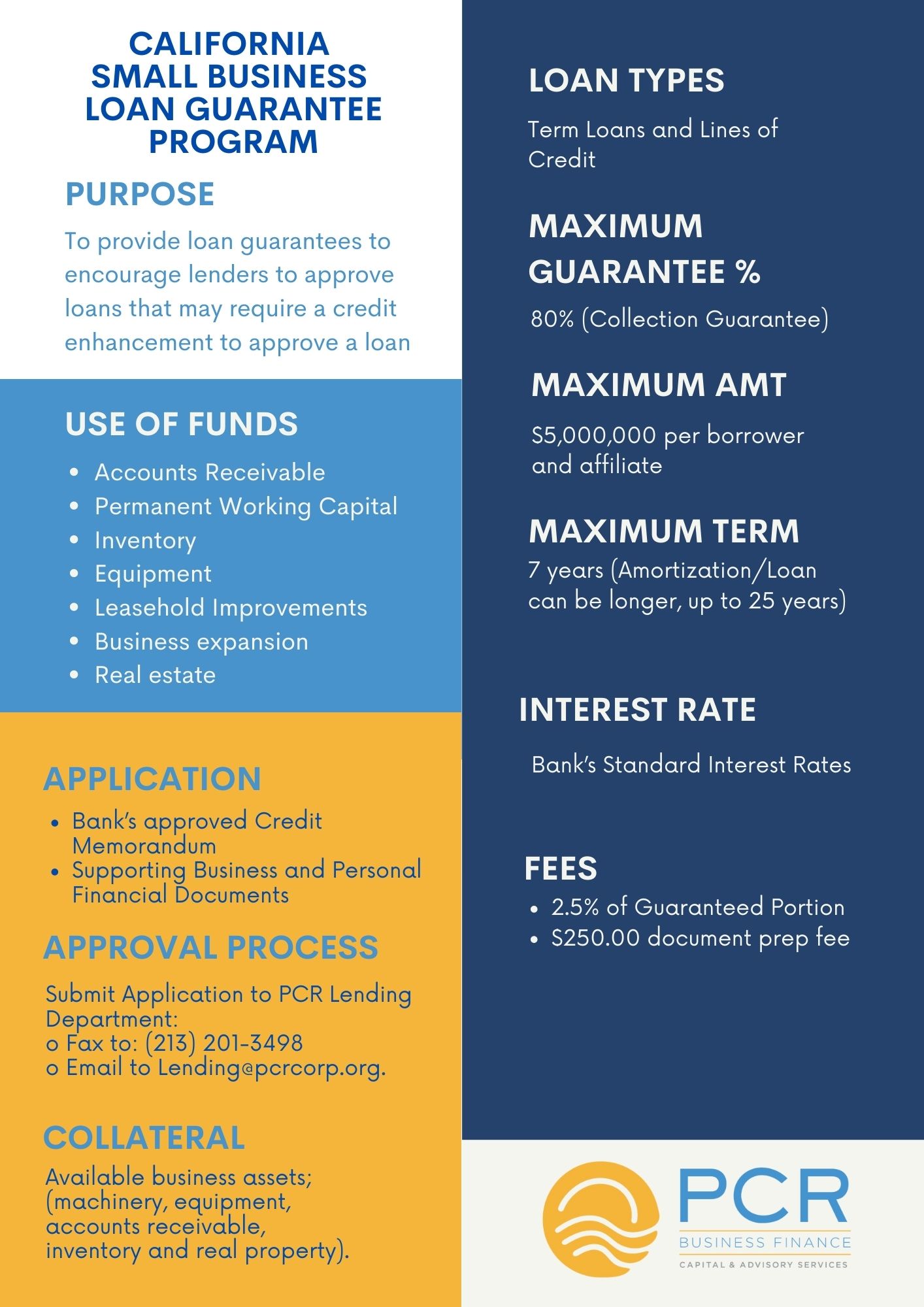

PCR’s lending portfolio includes programs targeted at historically excluded founders. In FY24, PCR successfully completed Cohort 3 of its SELF Loan Fund (Sacrifice Effort Legacy and Future), a vehicle designed to move capital to business owners who have traditionally had limited access to conventional financing.

When women secure capital and advisory support, we see immediate spillover effects:

- Jobs created close to home

- Stability for children and extended family

- Community-facing services (childcare, education, local food, health/wellness) that otherwise might not exist in the neighborhood

PCR’s work with women founders is not a short-term campaign. It’s core to how PCR sees economic mobility: when you fund women, you fund stability, care, and jobs.