— Our Blog —

Thankful For PCR Impact

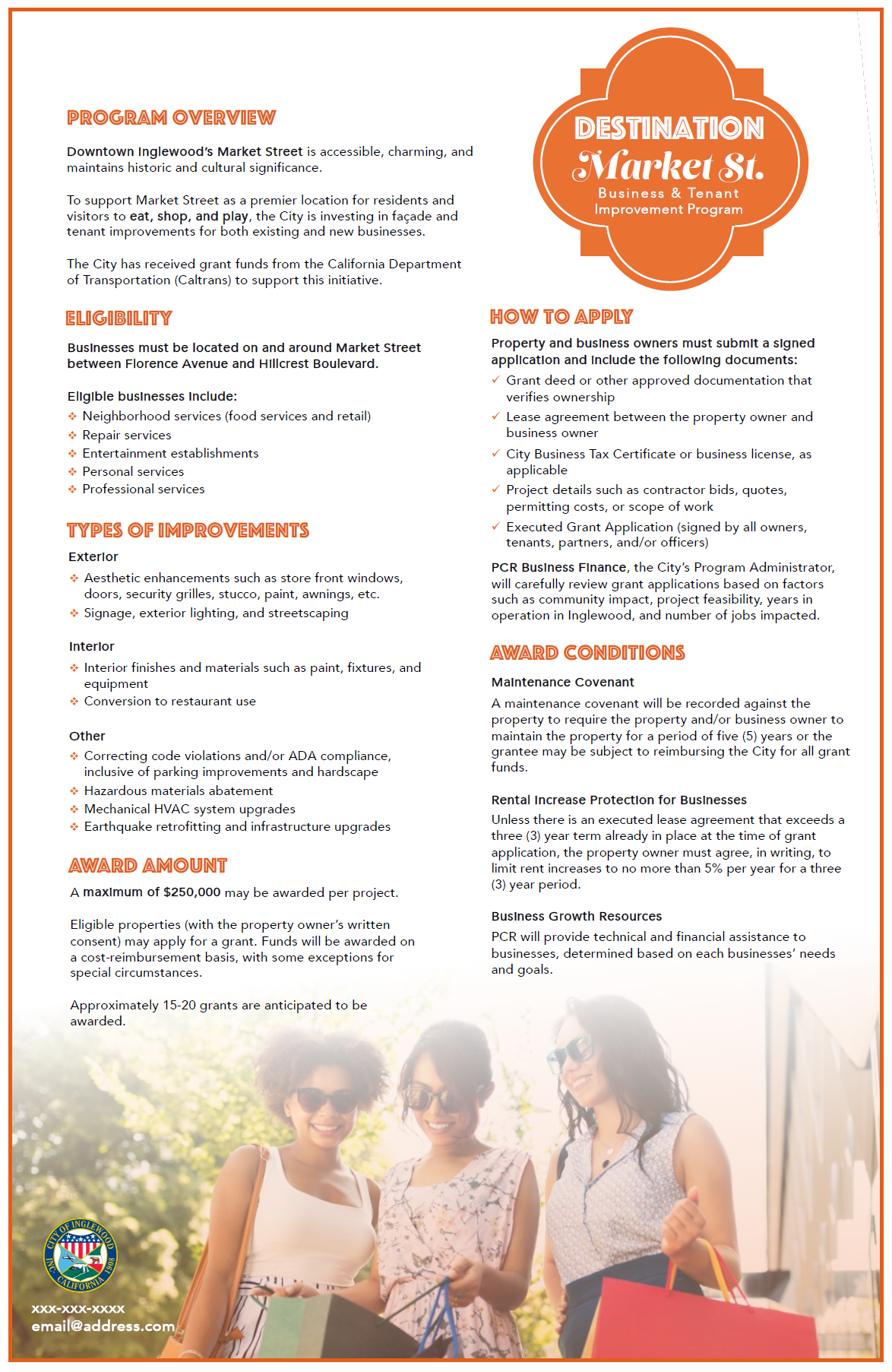

November is a natural moment to pause and recognize the work it takes to create real, local economic change. At PCR Business Finance, that work is shared – by founders, advisors, lenders, funders, and community partners who believe that access to capital should not depend on your zip code.

Celebrating Diverse Entrepreneurs

Los Angeles runs on entrepreneurship from communities with diverse backgrounds. From mobile food vendors and family cafés to childcare providers, contractors, and logistics companies, diverse-owned small businesses shape the economic and cultural life of entire neighborhoods.

The Importance of CDFIs

For many business owners (especially those in underserved communities) the challenge isn’t the business model. It’s access. Credit score requirements, collateral expectations, and underwriting assumptions often leave strong entrepreneurs locked out of traditional financing. That’s exactly why Community Development Financial Institutions (CDFIs) exist.

Mid-Year Check-In

Mid-Year Check-In: How to Strengthen Your Business Finances for the Second Half of 2025. July is the halfway point. It’s the moment where business owners can pause and ask: Are we healthy? Are we stable? Are we built to finish the year strong? PCR Business Finance regularly works with entrepreneurs at this stage of the year to review financial performance, adjust strategy, and plan for growth.

PCR Breaks Ground

June marked a turning point: PCR hosted a groundbreaking for a new community business hub, designed to bring lending, advising, and small business training together under one roof. This is more than a construction milestone. It’s a signal of intent. PCR is investing in physical infrastructure to sustain long-term economic mobility in the communities it serves.