New Year, New Goals: Financial Tips for Small Businesses in 2025

The new year is here, and with it comes an opportunity to set fresh goals for your small business. Whether you’re focused on expanding operations, boosting profitability, or simply maintaining stability, starting the year with a clear financial plan is key to success. At PCR Business Finance, we’re here to help you navigate the road ahead with confidence and resources designed specifically for small business owners.

Why Setting Financial Goals is Essential

Establishing clear financial goals at the start of the year helps you maintain focus, prioritize spending, and measure progress. It also allows you to anticipate challenges and build a proactive strategy to address them. For small businesses, goal setting isn’t just about growth – it’s about sustainability and long-term impact.

5 Financial Tips to Jumpstart 2025

- Assess Last Year’s Performance

Take a look at your financial records from 2024. What went well, and what could be improved? Identify trends in your revenue, expenses, and cash flow. This retrospective analysis provides valuable insights that can guide your 2025 strategy.

- Create a Detailed Budget

A well-planned budget is the backbone of a successful financial strategy. Break down your expenses into categories (e.g., payroll, marketing, operations) and set limits for each. Include a contingency fund to prepare for unexpected costs.

- Set SMART Goals

Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, instead of saying, “I want to increase revenue,” set a goal like, “I want to increase monthly revenue by 15% by July 2025 through expanding my product line.”

- Plan for Seasonal Fluctuations

If your business experiences seasonal peaks or slowdowns, build your financial plan around these patterns. Use peak periods to save for slower months, and consider securing financing to bridge any gaps in cash flow.

- Explore Funding Opportunities

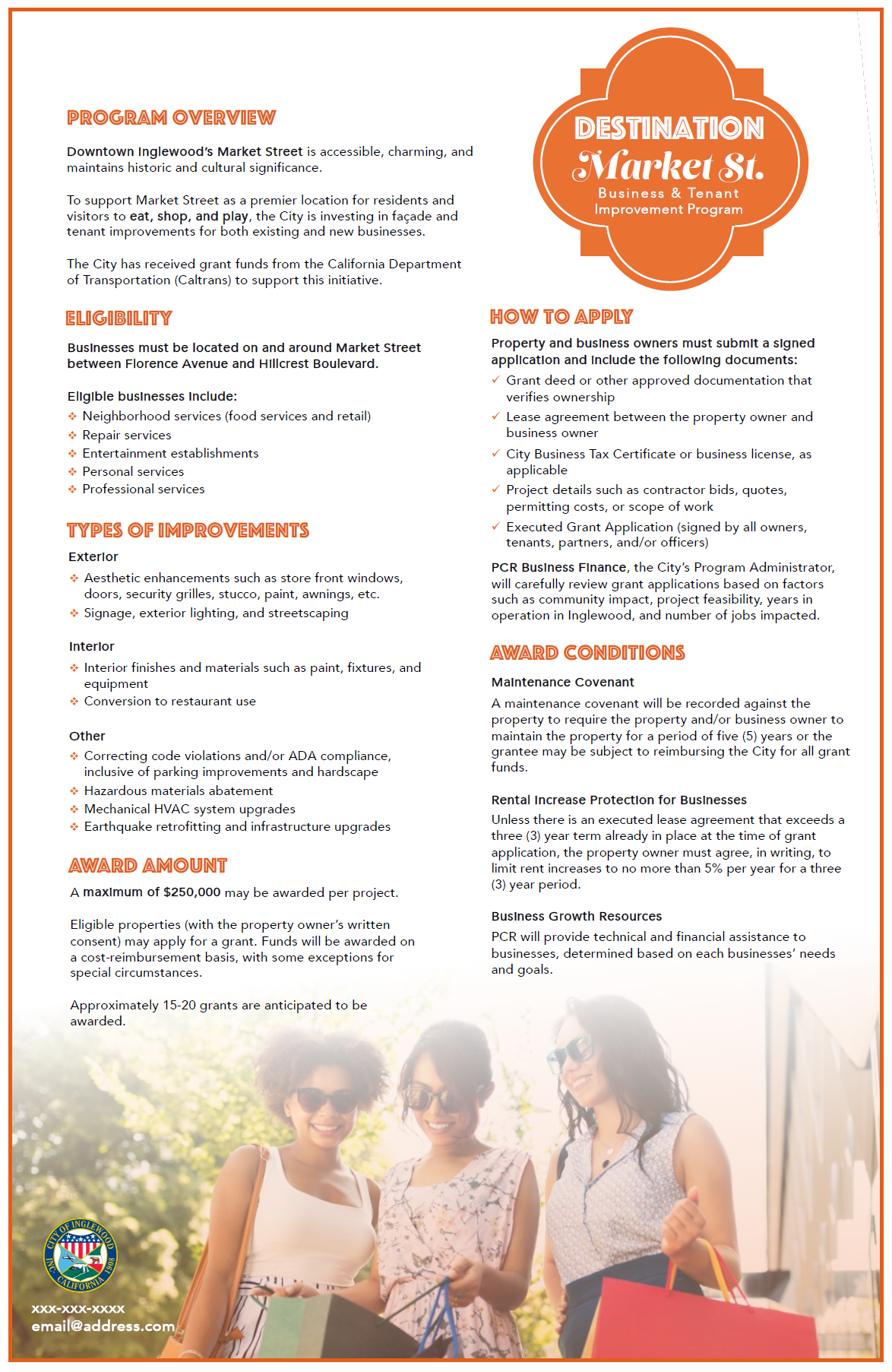

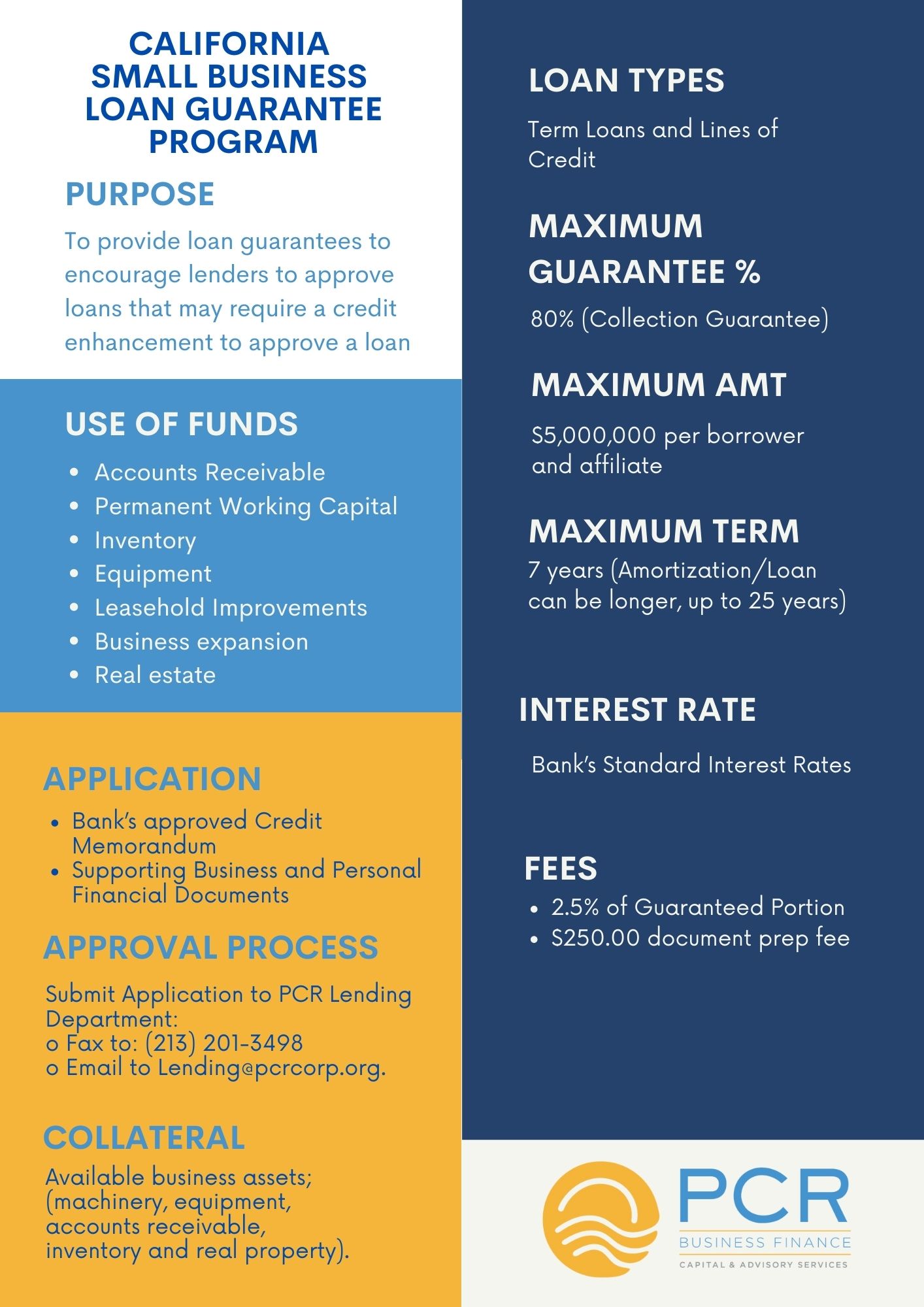

Sometimes, the key to achieving your goals is securing additional capital. Whether you need funds to hire staff, purchase inventory, or expand your operations, PCR Business Finance offers tailored solutions like the CA Small Business Loan Guarantee Program to help you succeed.

How PCR Business Finance Can Help

At PCR Business Finance, we’re more than just a lender—we’re a partner in your success. Through innovative programs like the CA Small Business Loan Guarantee Program, we provide small business owners with access to the capital they need to grow. Our team is dedicated to helping you navigate the financial landscape and achieve your 2025 goals.

If you’re ready to make this your best year yet, schedule a consultation with us today. We’ll work with you to understand your unique needs and recommend financing solutions that align with your vision.

Let’s Make 2025 Your Best Year Yet

The new year is full of possibilities, and with the right plan in place, your business can thrive. Start by setting clear financial goals, creating a solid budget, and exploring the resources available to you. PCR Business Finance is here to support you every step of the way.

Contact us today to learn how our loan programs and expert guidance can help you achieve your business dreams in 2025.