How to Strengthen Your Business Finances for the Second Half of 2025

July is the halfway point. It’s the moment where business owners can pause and ask:

Are we healthy? Are we stable? Are we built to finish the year strong?

PCR Business Finance regularly works with entrepreneurs at this stage of the year to review financial performance, adjust strategy, and plan for growth. That support is delivered through PCR’s SBDC, which provides no-cost advising and affordable training to small businesses at every stage.

REVIEW CASH FLOW — WEEKLY, NOT MONTHLY

Cash flow tells you how money is actually moving — not just what you think you earned.

- Are receivables coming in late?

- Are vendor terms tightening?

- Are you dipping into personal funds to cover business costs?

PCR advisors sit with clients and build rolling cash flow forecasts so owners can anticipate gaps and avoid crisis-mode decisions later in the year.

- CHECK YOUR EXPENSE TRENDS

Costs creep. Supplies go up. Insurance renews at a higher rate. Seasonal labor shifts.

Mid-year is a good time to flag what quietly got more expensive in Q1–Q2 and decide what to keep, what to renegotiate, and what to cut.

- PREPARE FOR TAXES AND COMPLIANCE

Even profitable businesses get caught off guard by quarterly tax payments, payroll obligations, and licensing renewals.

PCR’s SBDC offers ongoing “Financial Fitness” and “Loan Ready or Not?” workshops covering bookkeeping discipline, recordkeeping, and compliance so that owners stay prepared and fundable.

- ASSESS DEBT CAPACITY BEFORE YOU NEED IT

Many owners wait until they’re in a crunch to ask for capital. That’s backwards.

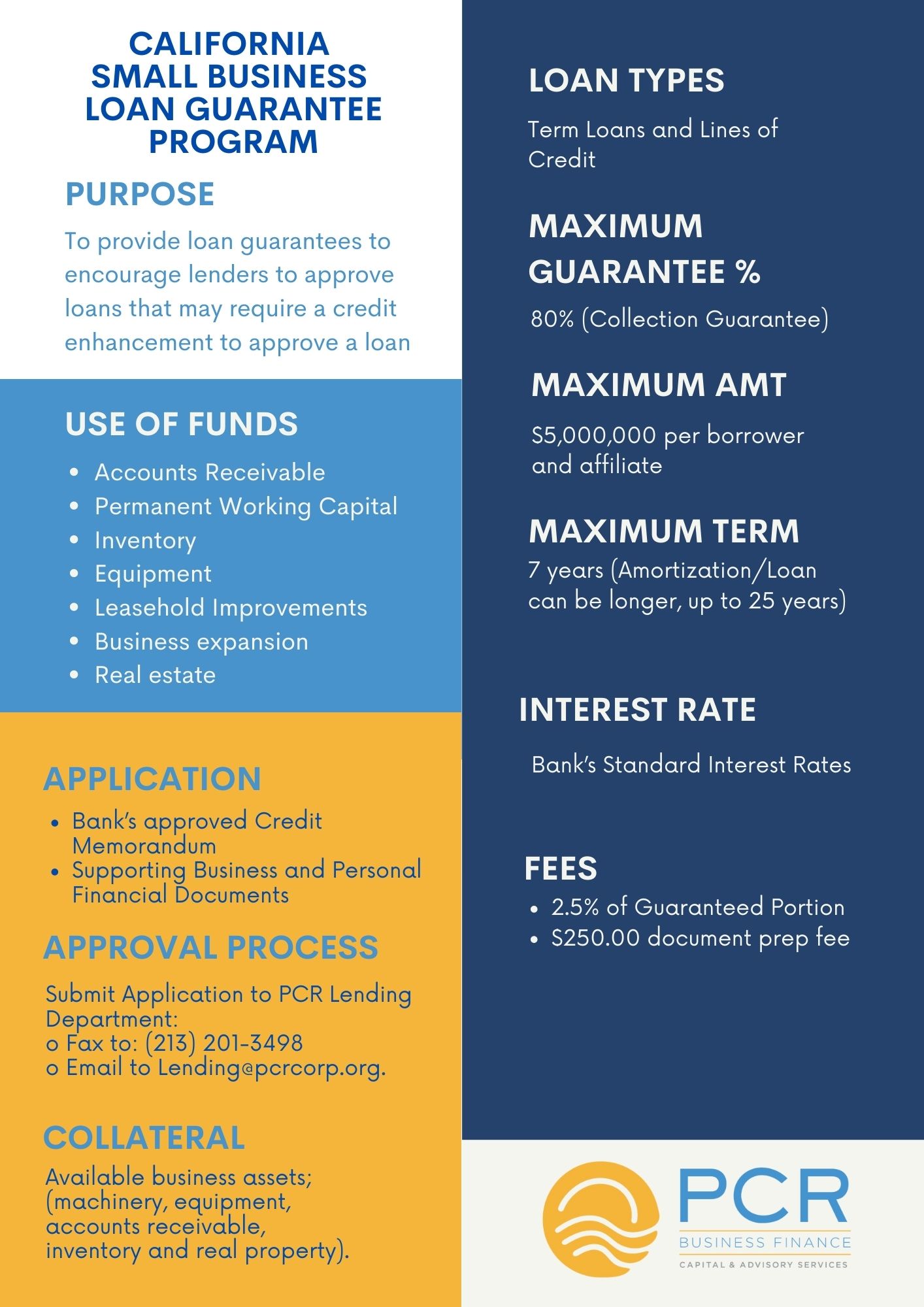

A mid-year review helps determine whether you could qualify for working capital, equipment financing, or a line of credit now — not after a crisis hits. PCR’s lending team and SBDC advisors work together so business owners understand what’s realistic and sustainable before they take on debt.

- IDENTIFY OPPORTUNITIES, NOT JUST RISKS

Stability matters, but so does growth.

For some entrepreneurs, summer is a chance to lean into expansion: a second location, a new service line, or a government contract. PCR advisors help founders think about strategic growth and certification pathways, including becoming procurement-ready for corporate or public sector buyers.

Mid-year is your moment to stabilize and grow. PCR’s advisors help entrepreneurs review cash flow, tighten expenses, and get capital-ready for the rest of 2025, at no cost through the PCR-hosted SBDC.