Why CDFIs Are Key to Building Equitable Economies

If you’ve ever been told “no” by a traditional lender, you’re not alone.

For many business owners (especially those in underserved communities) the challenge isn’t the business model. It’s access. Credit score requirements, collateral expectations, and underwriting assumptions often leave strong entrepreneurs locked out of traditional financing.

That’s exactly why Community Development Financial Institutions (CDFIs) exist.

PCR Business Finance is a nonprofit, U.S. Treasury-certified CDFI. That means its mission is to expand economic opportunity in underserved communities by providing access to capital and advisory services for local and ethnically diverse small business owners.

In plain terms: PCR was built to say “yes” responsibly and with support, in places where most lenders lead with “no.”

HOW CDFIs CREATE EQUITY

- Flexible capital

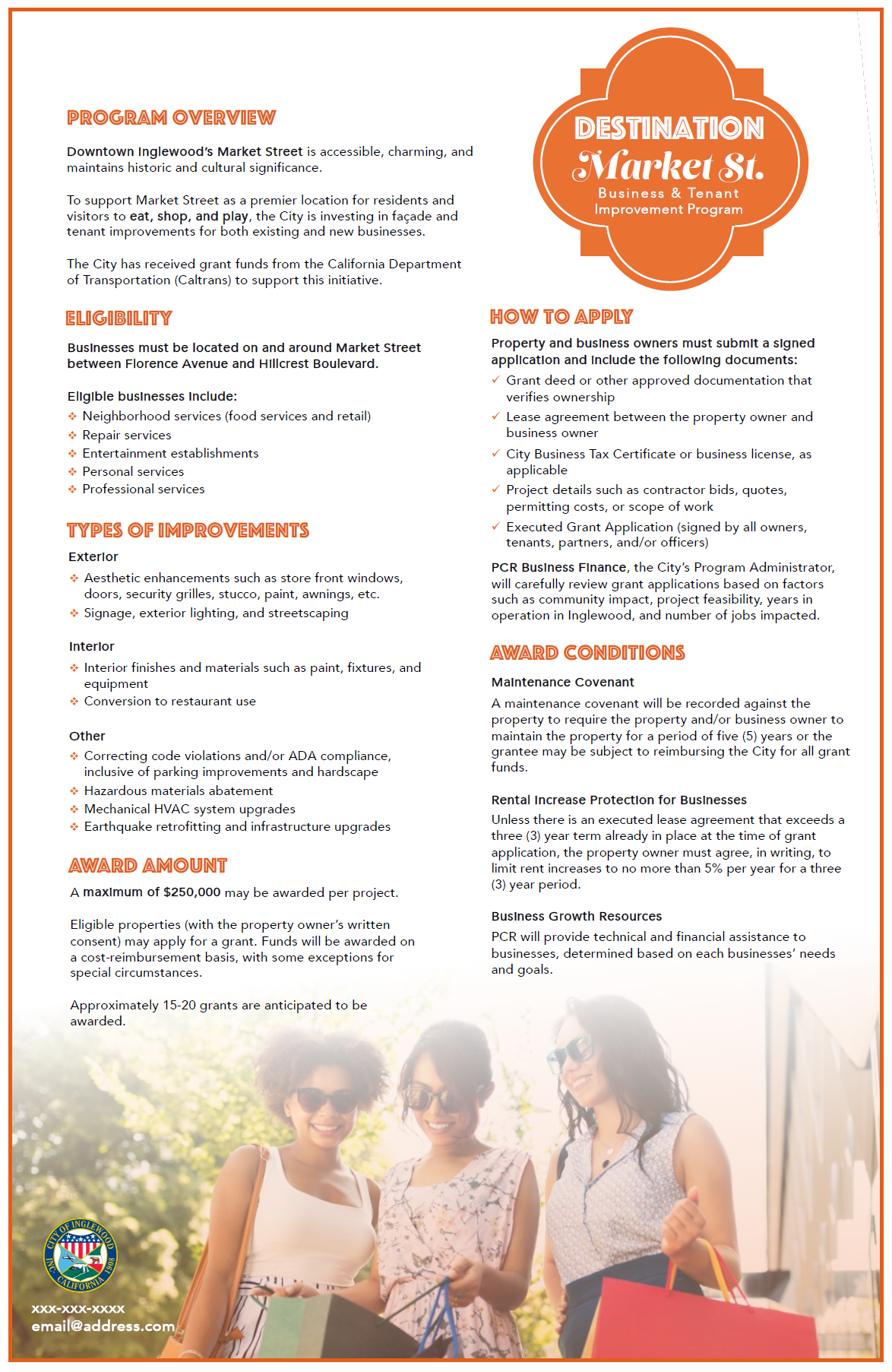

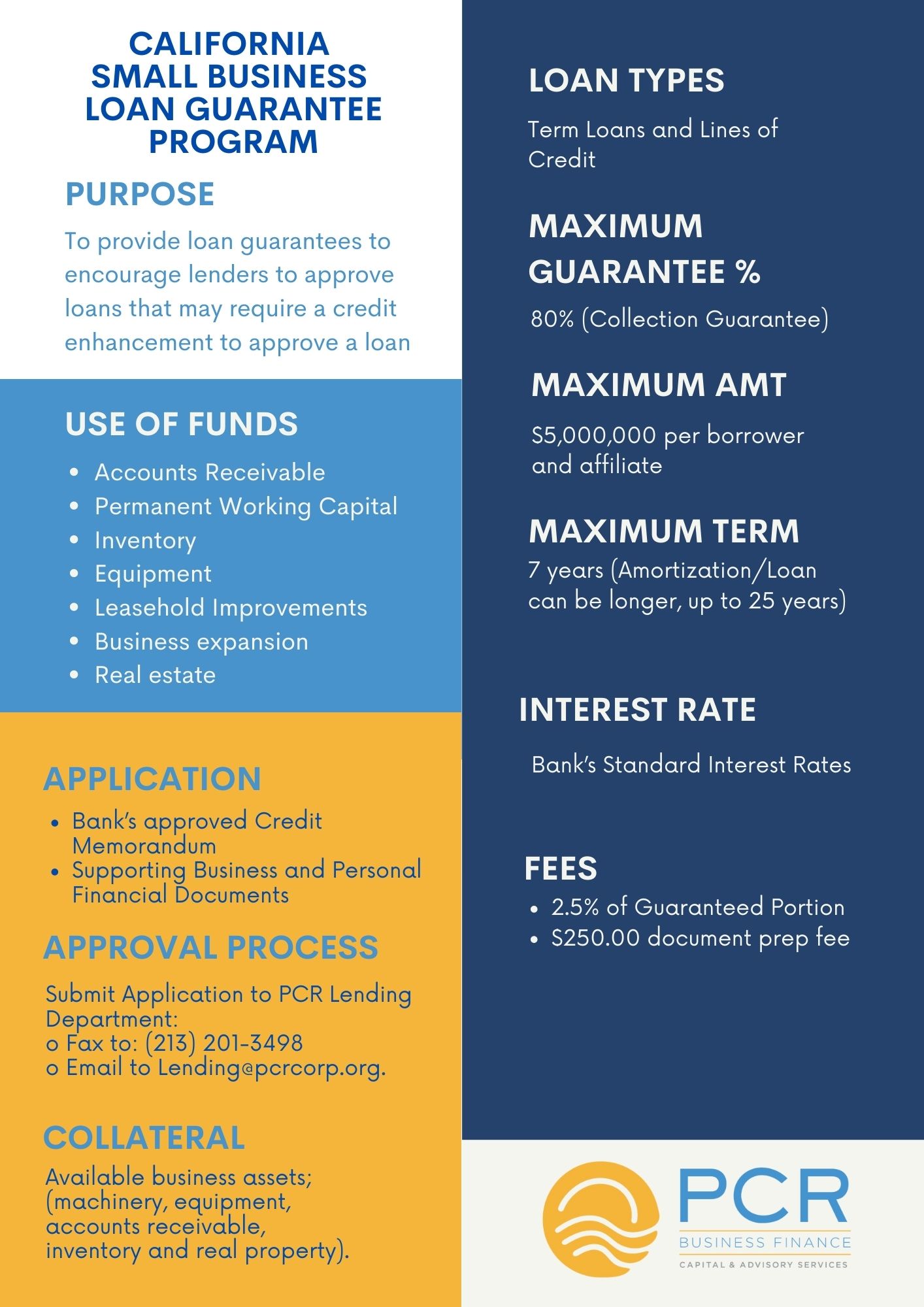

PCR’s lending programs include microloans, working capital, and loan guarantees through statewide programs such as the California Small Business Loan Guarantee Program. These tools are designed to meet businesses where they are, not where a bank wants them to be. - Technical assistance

Because PCR also operates as an SBA-designated SBDC, entrepreneurs receive no-cost advising and low-cost training to stabilize operations, manage cash flow, and build lender-ready financials. - Long-term relationship

PCR doesn’t treat a loan like a closing point. It treats it like the start of a partnership. That’s especially important for founders who are building a business to support a household, not to pitch a venture capitalist.

When small business owners can access capital on fair terms, they hire locally, create stability, and keep ownership in the community. That is how you build an equitable economy, not in theory, but block by block.