Unlocking Capital: A Recap of the SBA Loans Workshop Hosted by PCR Business Finance SBDC, with Guest speakers from the SBA, PCR Business Finance and US Bank.

This month, PCR Business Finance’s SBDC hosted a transformative workshop titled Unlocking Capital Your Guide to Business Growth with SBA Loans. The event brought together small business owners and industry experts to delve into the intricacies of the US Small Business Administration (SBA) loans. The workshop kicked off by emphasizing the crucial role of SBA small dollar lending in fueling the growth of businesses in LA County. The event aimed to enlighten attendees about the various avenues available for securing SBA loans and how these funds can serve as a catalyst for business expansion.

Delphine Pruitt, Vice President and Business Access Advisor, and Henry Rivas, Small Business Specialist, both from US Bank, shed light on SBA lending from a conventional bank standpoint. They navigated the audience through the difficulties of securing loans from a mainstream financial institution, offering valuable insights into the criteria, processes, and benefits associated with obtaining SBA loans through a conventional banking channel.

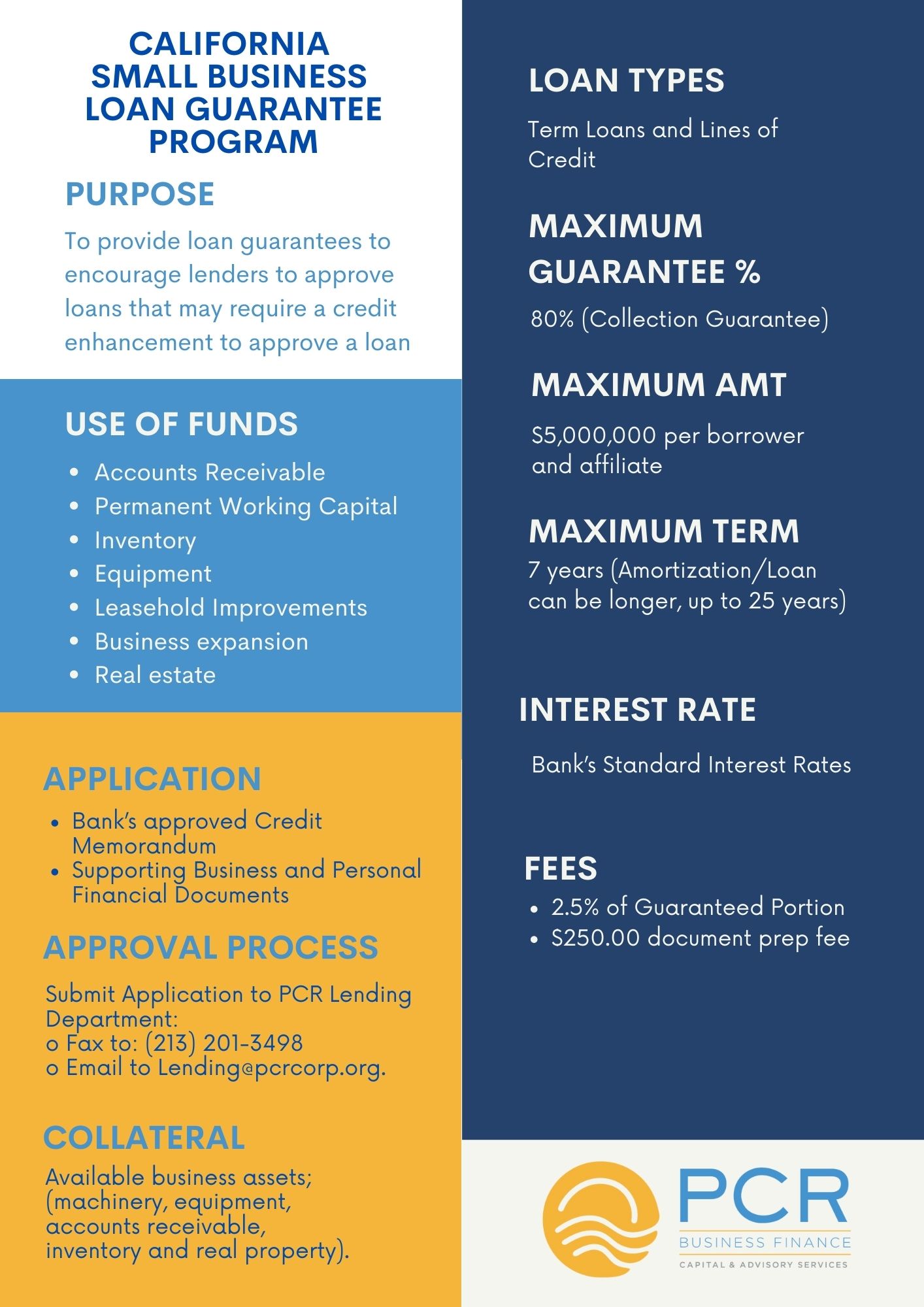

OC Isaac, Senior Vice President, and Chief Credit Officer at PCR Business Finance provided a unique perspective of SBA lending from a non-profit CDFI. Attendees gained a comprehensive understanding of how CDFI’s play a pivotal role in facilitating access to capital, particularly for businesses that may face challenges in the conventional lending space.

Director of SBA Los Angeles District Office, Julie Clowes took the stage to demystify the rules, policies, and eligibility criteria governing SBA lending. Her comprehensive presentation equipped the audience with the knowledge needed to navigate the regulatory landscape, ensuring that small businesses could make informed decisions when seeking SBA loans.

Throughout the workshop, small business owners from various industries actively engaged with the presenters, seeking personalized advice, and sharing their own experiences. The diverse perspectives enriched the discussion, creating a dynamic atmosphere where attendees could learn from both the experts and their peers. We are hopeful that The Unlocking Capital workshop was a valuable resource for the small businesses in attendance, and that we were able to provide a roadmap of sorts, for navigating the complexities of SBA loans… stated OC Isaac.

By bringing together conventional banks, CDFI’s, and SBA authorities, the event facilitated a holistic understanding of the diverse pathways available for securing capital. As small businesses continue to drive economic growth, initiatives like these play a pivotal role in empowering entrepreneurs and fostering a resilient business ecosystem.