What Makes a Small Business Sustainable: Financial Practices That Support Longevity

Starting a business is an achievement. Sustaining one is the real challenge.

Across industries, many small businesses experience early momentum but struggle to maintain stability over time. The difference between short-term survival and long-term sustainability is rarely about passion or product – it’s about financial practices, planning discipline, and access to the right support.

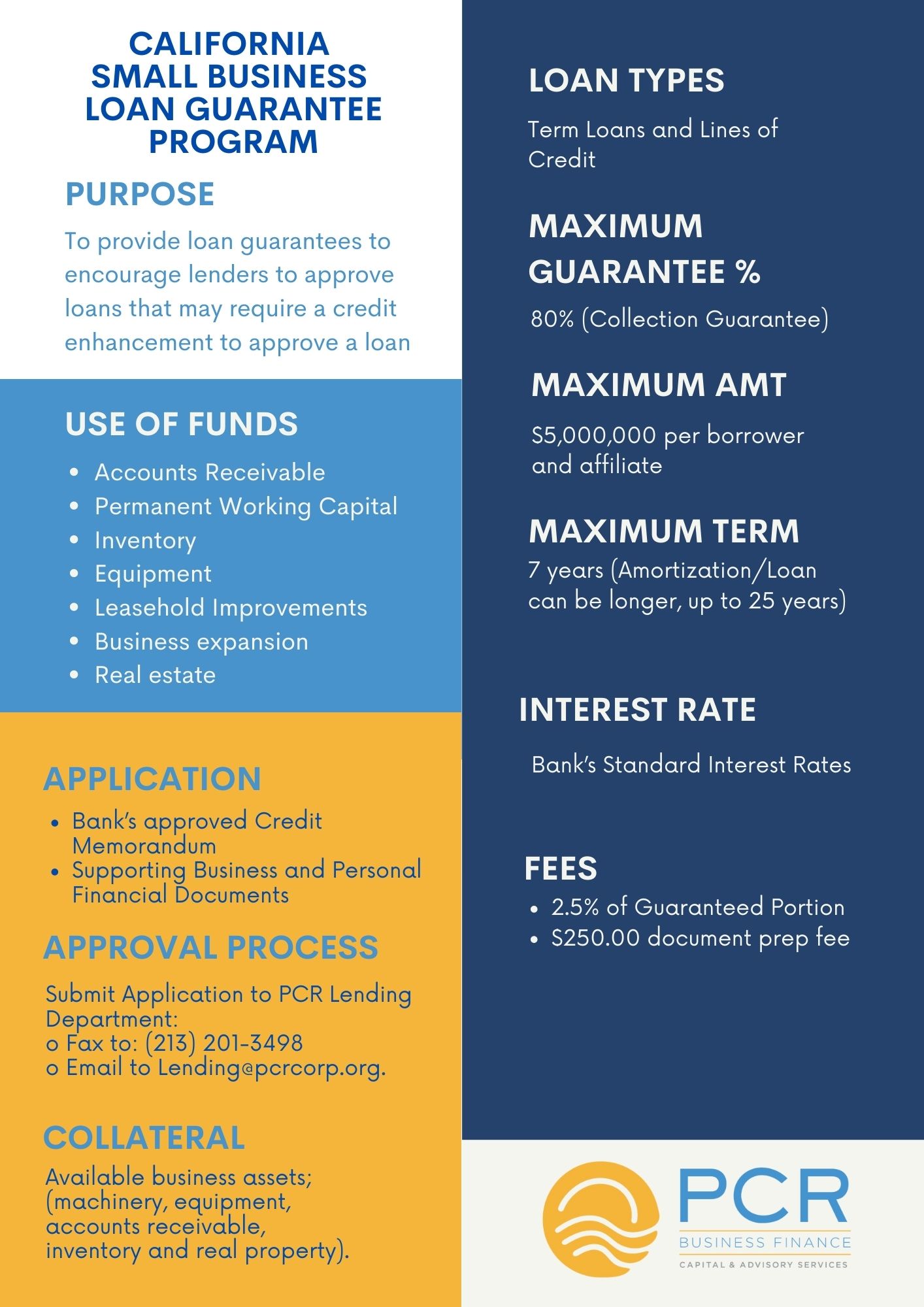

At PCR Business Finance, sustainability is the lens through which lending and advising are delivered. The goal is not simply to help businesses launch, but to help them last.

Sustainability Begins With Cash Flow Management

Revenue alone does not sustain a business. Cash flow does.

Sustainable businesses understand the timing of money moving in and out of the business. They monitor receivables, manage payables, and maintain visibility into short-term obligations. Without this discipline, even profitable businesses can face liquidity challenges.

Regular cash flow forecasting allows owners to anticipate pressure points and adjust early, rather than responding after problems arise.

Debt as a Tool, Not a Burden

Access to capital is often essential to sustainability but only when debt is structured responsibly. Sustainable businesses take on financing with a clear understanding of repayment terms, impact on cash flow, and alignment with business goals.

PCR’s lending philosophy emphasizes appropriate leverage. Capital should support revenue generation, operational efficiency, or long-term stability—not introduce unnecessary strain.

When paired with advisory support, financing becomes a stabilizing force rather than a risk factor.

Operational Discipline Builds Confidence

Sustainability is reinforced through systems: bookkeeping processes, payroll management, inventory controls, and documentation. These systems reduce stress, improve decision-making, and increase credibility with partners and lenders.

Sustainability isn’t accidental. It’s built through disciplined financial practices, responsible capital use, and long-term planning. Here’s what helps small businesses last.

As a mission-driven lender and advisor, PCR integrates capital access with hands-on guidance. This model supports sustainability by ensuring financial decisions are informed, strategic, and aligned with long-term goals.