Quarter 1 Wrap-Up: 3 Things Every Small Business Should Do Before Entering Q2

The first quarter of the year always moves fast, and for many small businesses, it’s been a mix of momentum, refinement, and setting the tone for growth.

At PCR Business Finance, we believe in helping entrepreneurs not only access capital, but make informed, strategic decisions. As we close out Q1, here are three ways to get clear and prepared for what’s next:

1. Review your numbers and the story they’re telling.

Cash flow, sales, and monthly expenses should be reviewed with intention. What patterns are emerging? Where are you over- or under-spending? This is the foundation for your next quarter’s budget and funding strategy.

2. Revisit your goals and adjust accordingly.

Whether you hit all your Q1 goals or need to pivot, take 30 minutes to realign your business goals to what’s realistic and motivating for Q2.

3. Prepare for capital before you need it.

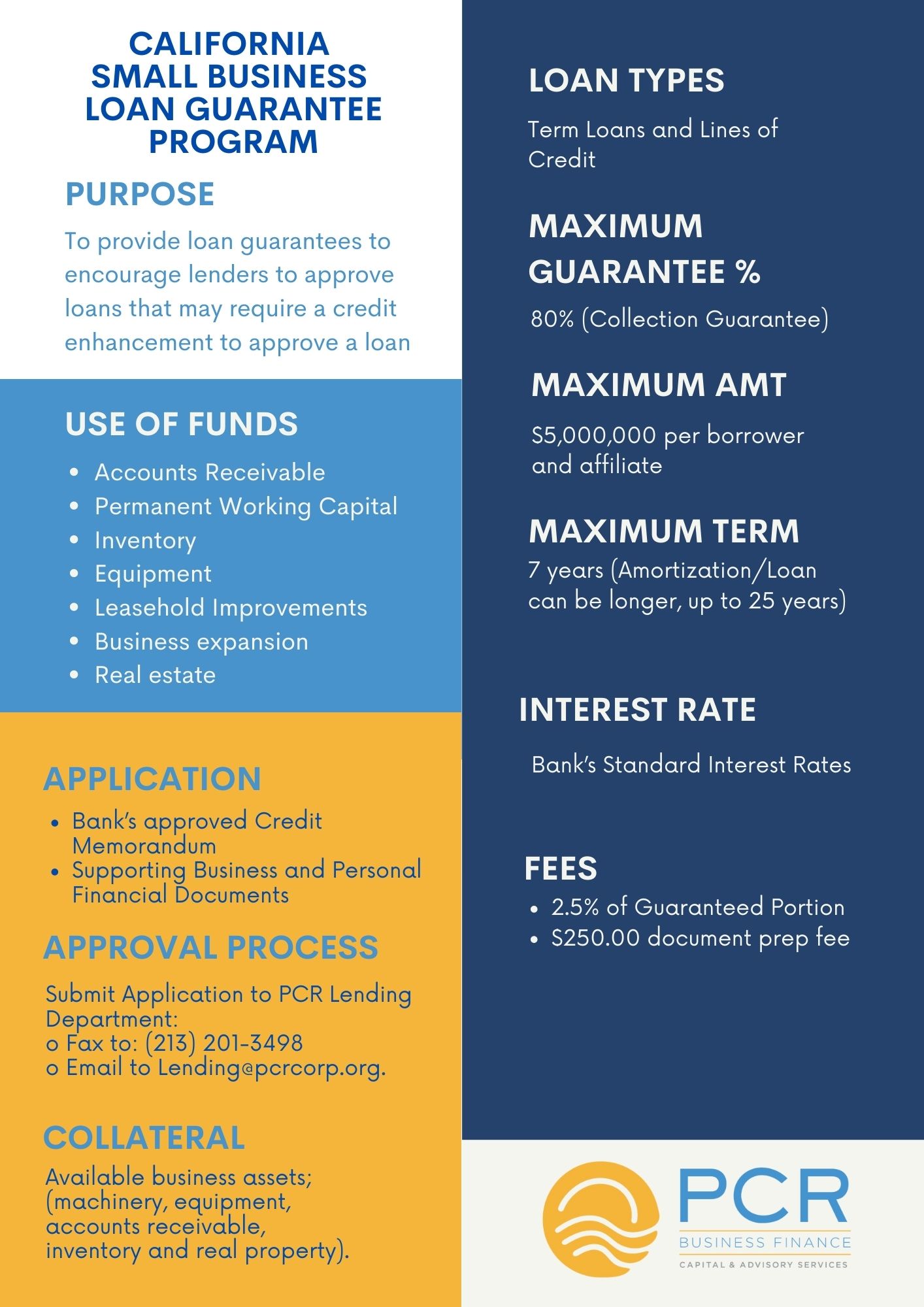

One of the biggest mistakes business owners make is waiting until it’s urgent to explore funding. Whether you’re thinking about a line of credit, equipment purchase, or expansion later this year, now is the time to get your paperwork and plan in order.

We’re here to help with all of that and more.

If you’re a business owner looking for support in funding or technical assistance, connect with our team. Let’s make Q2 your strongest quarter yet!