Setting Your Small Business Up for Success

As we approach year’s end, it’s the perfect time for small business owners to take stock, streamline operations, and prepare for the coming year. Whether you’re looking to stabilize cash flow, strengthen your team, or grow your market presence, intentional planning now can help set the stage for long-term success. Below are a few key areas to consider as the calendar turns.

1. Review Financial Performance and Cash Flow

Take a close look at your profit and loss statements, balance sheets, and cash flow forecasts. Identify trends, spot potential shortfalls, and determine whether you need financing or cost adjustments to start the New Year stronger. Understanding where you stand financially empowers you to make informed decisions, whether that’s securing additional working capital or renegotiating terms with suppliers.

2. Update Your Business Plan and Goals

Your business plan should evolve as your company grows. Review what worked this year—and what didn’t. Are there new markets to tap into or product lines to refine? Set measurable and attainable goals, such as increasing sales by a certain percentage or improving customer retention. A refreshed roadmap ensures everyone on the team is aligned and motivated.

3. Invest in Your Team and Processes

A strong workforce and efficient operations are critical to long-term growth. Consider year-end bonuses or professional development opportunities to show appreciation and strengthen skills. Likewise, review your internal processes, from invoicing to customer service, to find areas where technology or training can improve productivity and profitability.

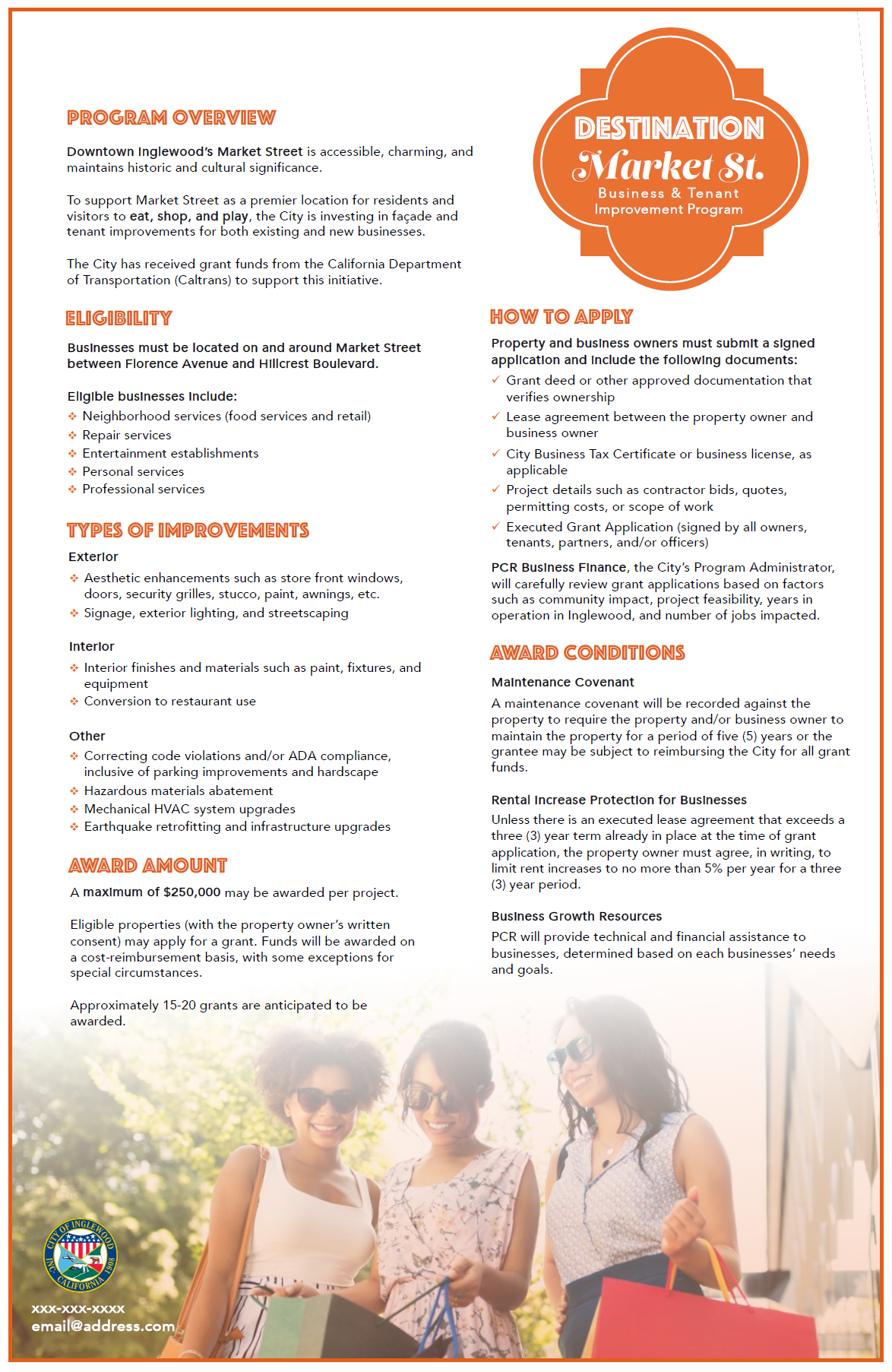

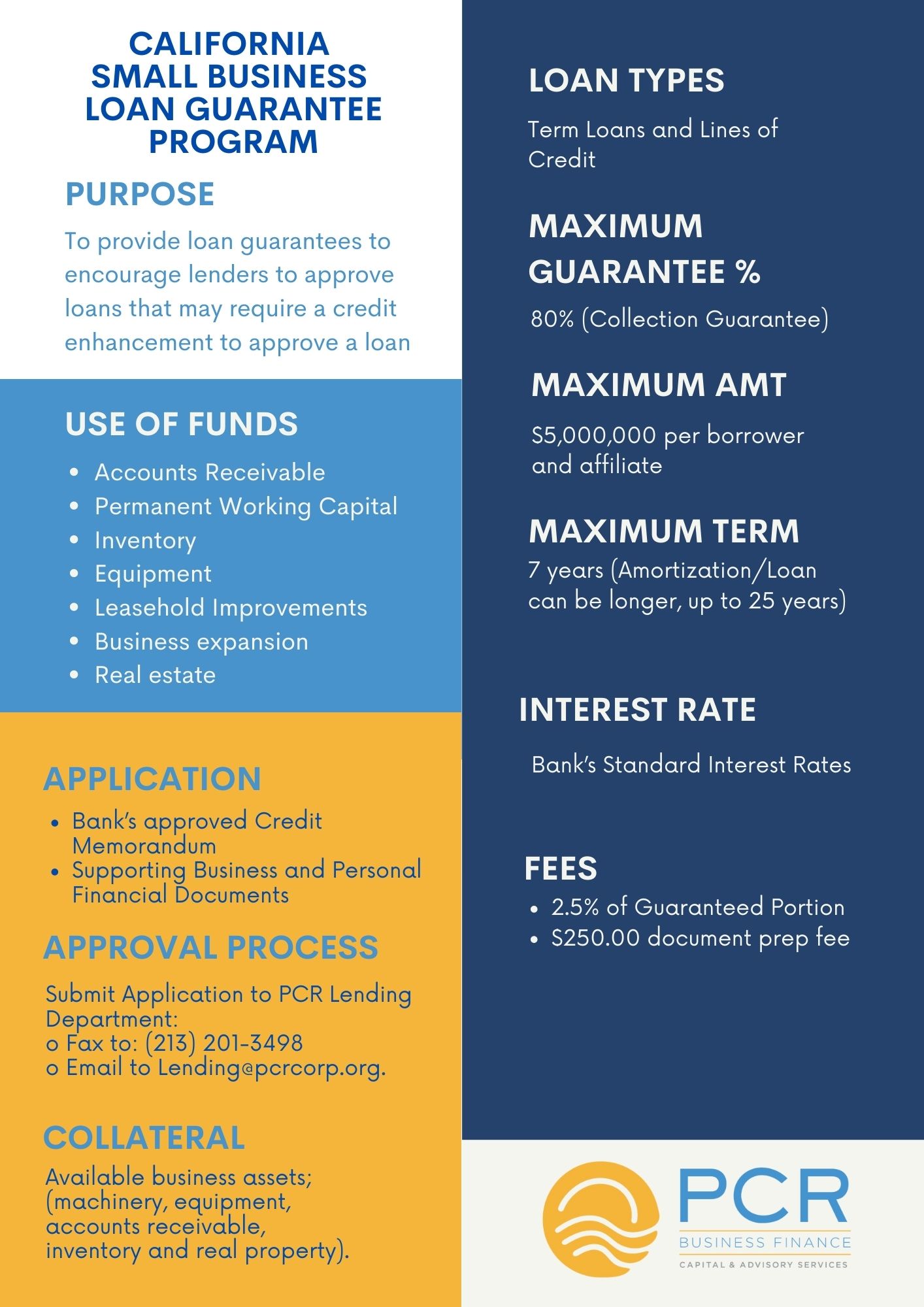

4. Explore Funding Options and Technical Assistance

As you look ahead, consider whether additional capital or expert guidance could help you achieve your goals. Perhaps you’re aiming to expand your product line, upgrade equipment, or refine your marketing strategy. This is the time to evaluate your borrowing options, establish relationships with lenders, and seek out tailored technical assistance that can help you navigate challenges and identify opportunities.

Ready to Take the Next Step?

Our Direct Lending Team at PCR is here to help you access the financing you need to bring your vision to life. If you’re seeking capital to grow your business, contact our lending professionals for guidance on the best loan options available. Call (213) 739-2999

Not sure where to start or want to refine your strategy before committing to a loan? Our Small Business Development Center (SBDC) team offers expert technical assistance to help you clarify your business plan, streamline operations, and position yourself for success. Call us at (213) 674-2696

Make the most of this transition period. Reach out to us and start the New Year strong!